NEW ITR FORMS

New ITR Forms released by Income Tax Department! Deadline extended till 31st August!

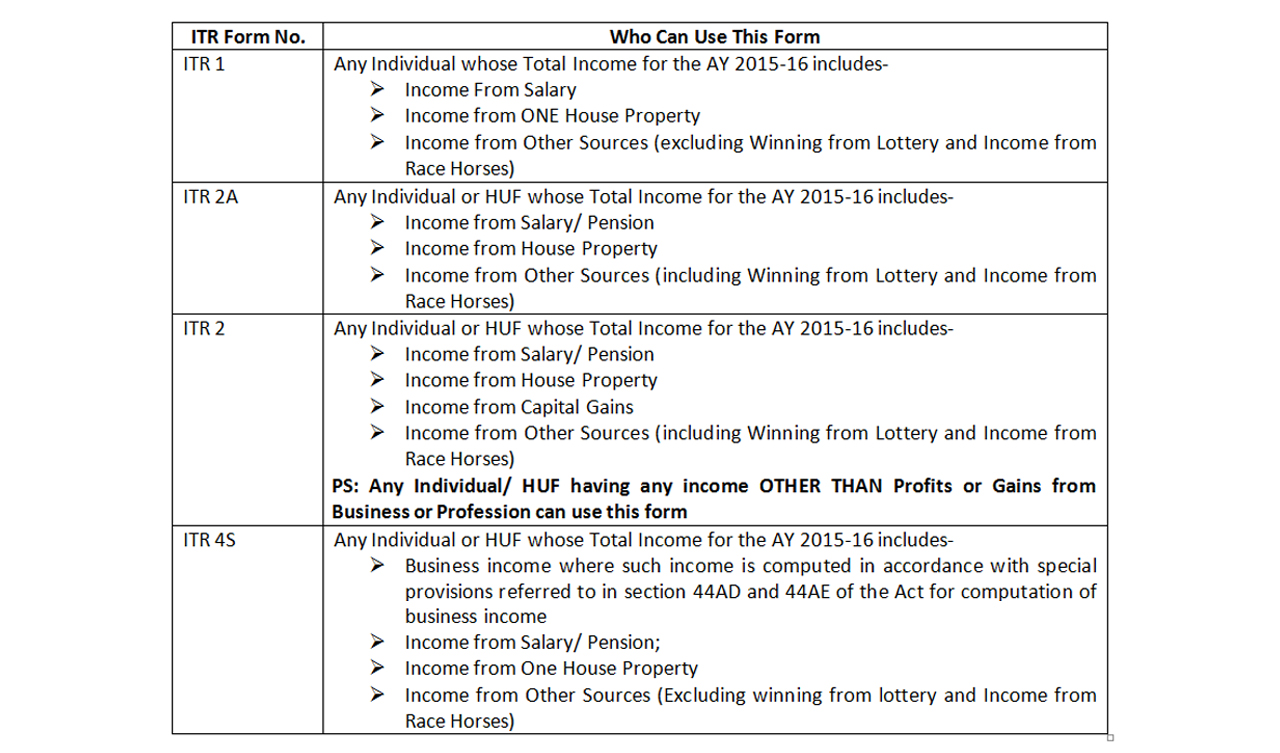

CBDT has notified the new and simpler Income Tax Return Forms vide Notification No. 49/2015 dated 22nd June, 2015. A list of the forms notified so far.

The major changes made in the form are:

The IFS Codes and Account Numbers of ALL Bank Accounts operative at any time during the previous year need to be furnished. However, details of Dormant Accounts inoperative since past 3 years need not be given.

Passport Number and AADHAR Number if available need to be provided in the returns.

Tax Payers can start the e-filing of forms ITR 1 and ITR 4S. However, the excel utility of ITR 2 & ITR 2A is yet to be made live. To the relief, the due date of filing Income Tax Returns has been extended from 31st July to 31st August.

For ITR Filing and other auxiliary services log on to www.dcstax.in or Call us @ +91 98363 88555.

Client Oriented

DCS aims to provide a solution specifically tailored for you. The team distinguishes itself by delivering services which are directly attributable to the areas of compliance for the client.

ACCURACY

DCS strives to attain perfection and accuracy through its unwavering commitment. Our project with every client is handled very carefully and the execution is in safe expert hands.

COST EFFECTIVE

The best quality services are assured at a very reasonable price. We wish to maintain our competitive presence by keeping client's cost burden at the minimum.

OUR SKILLS

DCS

Organization's Declaration

Vision

DCS envisions a comfortable tax and compliance world for its clients. We intend to provide the best experience to our clients, right from the enquiry to the completion of the project. This is a two way journey and will be successful only on the complete understanding between the two. We wish to create a sense of security in the minds of our clients. We aim to nurture a winning network of clients and their tax partner; together we create mutual, enduring value.

Mission

DCS strives for the success of its client network by creating a vivacious work environment that focuses on creative solutions that deliver confidence in a sustainable and socially responsible manner. The team at DCS is focused and well aligned hence, it assures the most appropriate solution for all the tax and compliance related perturbation.

STRENGTHS

- A very dedicated team

- Strong knowledge base

- Distinguished time and work management skills

- Positive and active work environment

- Regular updates on the changing laws and rules

WEAKNESSES

- A not so strong brand name

- Limited presence in the global market

OPPORTUNITIES

- Rapidly growing need for tax planners and managers

- Emergence of new tax regimes like GST

- Growing awareness in small and young entrepreneurs regarding the need of effective maintenance of books and accounts

THREATS

- Increasing competition

- The dynamic tax system which changes every now and then

- Creating and developing the brand name